How to Get Buy One, Get One FREE Flights for Nearly TWO Years!

No matter where you travel, flights will likely be one of your biggest expenses. Sometimes you may get lucky and snag some super-cheap flights like we did on our trip to Fort Lauderdale this past fall. However, in many cases, you’ll be forking out a good chunk of cash to fly to your destination.

We’ve never been loyal to any one airline—we’ve always just chosen the cheapest airline with the best flight times. However, we just earned Southwest Airlines’ coveted Companion Pass, which gets us buy one, get one FREE flights for nearly two years!

If you don’t know what Southwest’s Companion Pass entails or how you can earn it, read on!

What is the Southwest Companion Pass?

Southwest’s Companion Pass allows you to choose one person to fly with you FOR FREE whenever you purchase or redeem points for a flight. You are still required to pay any taxes and fees, but domestic flights are typically $5.60 one-way. This benefit can be used an UNLIMITED number of times while your Companion Pass is active.

When does a Companion Pass Expire?

The Companion Pass is good for 1-2 years, depending on when you earn it. The key is to earn it as early in the calendar year as possible to maximize the length of the pass. In our case, we earned the Companion Pass on February 3rd, 2024, which means that it’s good for the rest of 2024 and all of 2025, giving us nearly two years of BOGO Free flights!

How do I get a Companion Pass?

There are a couple of ways to earn the Companion Pass.

Fly 100 qualifying one-way flights

If you’re a frequent-flyer with Southwest, you can earn it by flying 100 qualifying one-way flights in a calendar year. We like to travel, but we don’t come close to flying that often! The good thing is that there is a much easier way!

Earn 135k Rapid Rewards Points

The other option to score this pass is to earn 135,000 qualifying points in a calendar year. Rapid Rewards is Southwest’s loyalty point program. You earn Rapid Rewards points when you fly, but also when you make purchases on one of Southwest Airlines’ credit cards. However, if you relied on everyday spending, you’d have to spend A LOT of money to rack up those points seeing as you only earn 1% back on everyday purchases. Purchasing flights through Southwest earns you more percentage back, but it’d still take quite a bit of spending to get there.

Fast-Track to Earning 135k Points

The good thing is, you can fast track your point earning with Southwest welcome offers. When you sign up for a new credit card, you’re often given a large one-time point bonus (welcome offer) when you hit a minimum spend in a certain time frame. Currently Southwest is offering a bonus of 50k points after you spend $1k in 3 months. That one credit card would get you almost half of the points you need for a Companion Pass. And in our case, there was an elevated offer that actually got us 75k points, getting us MORE than half way to the goal!

That means that you still need one more large bonus to earn enough points for the Companion Pass. Southwest only allows you to hold ONE personal credit card, even though they have several to choose from. In order to get that next welcome bonus, you can opt for one of their business credit cards. Now you obviously need to have a business to get a business credit card, but the term “business” refers to pretty much any side hustle you can think of.

I actually have several side hustles! I have an Etsy shop where I sell customized Disney Autograph Pillow Cases, I resell items on Facebook Marketplace, run this blog and sell our unused timeshare weeks at Sandos Resorts. These businesses and others will qualify you to apply for business credit cards. And by adding a Southwest Business credit card to your collection, you can earn the rest of the points you need to earn a Companion Pass! We decided to go with the Southwest Performance Business card, which gave us 80k points after hitting the minimum spend within three months.

Timing is Everything!

The key to earning a Southwest Companion pass is to ensure you get all of your points in the same CALENDAR year. Ideally, you’d want to earn all of your points at the beginning of the year so you can hold your Companion Pass for nearly two years.

In order to hit the minimum spend amounts on the two cards we signed up for, we needed about three months to hit the goal. So we signed up for one of our Southwest cards in early November and the other in mid-December. Because we signed up prior to the first of the year, we had to be careful to NOT hit the minimum spend until AFTER January 1st on BOTH cards.

Remember, the Companion Pass is good for nearly two years—IF you time it right. I officially hit my minimum spend on my first card at the beginning of January and my second card at the beginning of February. This means that I earned the Companion Pass for the rest of 2024 (Feb-Dec) and then ALL of 2025, which is nearly two years!

Meeting your minimum spend

Where it gets tricky is if you accidentally meet your minimum spend BEFORE the beginning of the year. If I would have earned all of my points and Companion Pass in December 2023, then the pass would have only been good for the rest of the 2023 year (spoiler alert—that’s less than a month) plus all of the following year (2024). One year of BOGO free flights is still a good deal, but because we timed it right, we ended up with almost TWO years of BOGO flights!

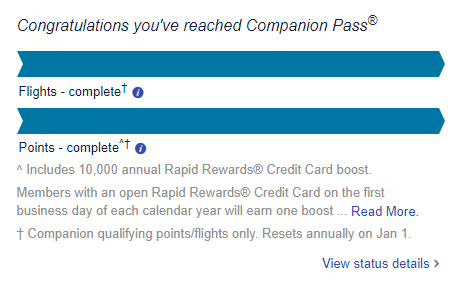

Once you’ve hit the minimum spend, the welcome offer bonus points will be added to your Rapid Rewards account when your credit card statement closes. In our case, our credit card closed on Feb. 3rd and our second welcome bonus was added to our Rapid Rewards account putting us over the 135k goal and earning us the Companion pass for the rest of 2024 and all of 2025!

And since I already had some flights booked, I just had to cancel my husband’s flight and add him on as my companion. The money/points I spent on those pre-booked flights were refunded to my account almost immediately! The only caveat to booking your companion is that the flight can’t be sold out. As long as there are seats available (in any fare type), you can add your companion for free!

Welcome offers

It’s also important to note that our welcome offer for the personal card gave us 75k points and the business card gave us 80k points, which was already enough to earn the Companion Pass. In addition to that though, we also earned points on the money we spent on the card (1%). All of these points go into my Rapid Rewards account and can be used to purchase future flights!

With the current offers out there, you’d earn 50k points on the personal card and 80k points on the business card, which takes you to 130k points—5k shy of the Companion Pass. But remember, spending 5k between both cards will earn you another 5k points (with the 1% back in points on everyday spending), giving you enough points to qualify for the Companion Pass!

It’s also important to clarify that the Companion Pass benefit does not COST you 135k points. When you earn the points, the pass is given to you as an ADDED benefit. So, once you earn the Companion Pass, you’ll have BOGO free flights PLUS 135k points to use on future flights!

Who can be my companion?

Once you earn your Companion Pass, you’ll be able to go into your Rapid Rewards account and add your companion. You have the ability to change your companion 3x in a calendar year. For us, I set my husband as my companion since he’ll likely be traveling with me most of the time. However, I could always swap him out with any other person at a later time (child or adult).

The key here is that your companion has to stay listed as your companion until after your flight with them is over. For example, we have a trip booked in March so I can’t change my companion until AFTER that flight is over. Now in April, I can switch my companion to my sister and fly with her over the summer and then change it back to my husband when we get back and fly somewhere in the fall with him. I just wouldn’t be able to book a fall flight with my husband as my companion until AFTER my sister and I took our summer trip.

Other Expenses to Consider when earning the Companion Pass

Taxes & Fees

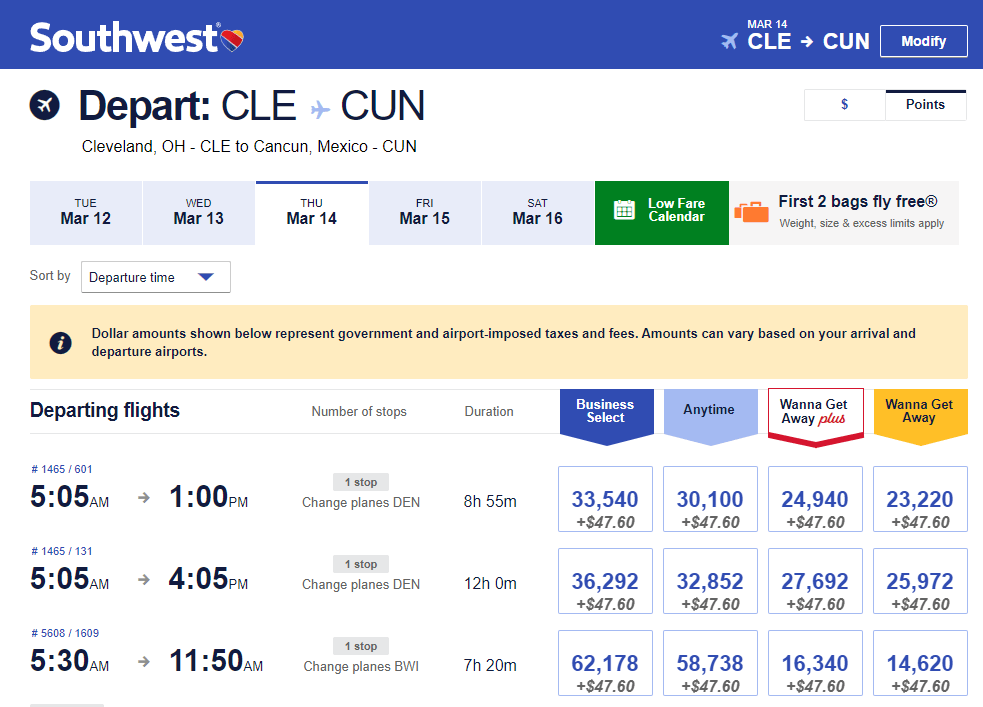

I’ve mentioned that the companion flights are free, other than taxes and fees. Whether your companion is flying free or if you’re using points to book flights, you’ll always be responsible for paying the taxes and fees. Typically, if you’re flying domestically, fees are only $5.60 each way.

However, if you fly outside of the U.S., your fees can be higher. It’s good to keep that in mind because in some cases, the Companion pass may not make sense to use—especially if you were able to score really cheap flights. Just keep in mind that Southwest also doesn’t charge for seats or bags, but those cheaper airlines do. Those costs add up fast, so just be sure to consider those added fees in your total cost when comparing prices!

Credit Card Annual Fees

No matter which Southwest Card you choose, they all have an annual fee. The Southwest Plus personal card has the lowest annual fee of $69, while the Southwest Performance Business Card has a steep $199 fee.

Some of their other Business Card options have lower annual fees, but this card has some added perks that made the fee worthwhile. For instance, my husband and I both recently got TSA PreCheck, which allows us to breeze through security using that really short line! The cost for TSA PreCheck was $78 for each of us, but the Southwest Performance Business Card credited me for this.

In addition, the Performance Business card gives me 365 Wi-fi credits/year. If I want to purchase Wi-fi on any Southwest flight, I’d have to pay $8/device for each leg of the flight. Having a family of 5, internet on a non-stop flight would cost us $40! I can use 5 Wi-fi credits instead and save quite a bit of money and not hear my kids complain about being bored on a long flight!

We also get 25% off in-flight purchases and 4 upgraded boardings/year. These added bonuses make that annual fee almost non-existent!

How many points do I need to book a flight?

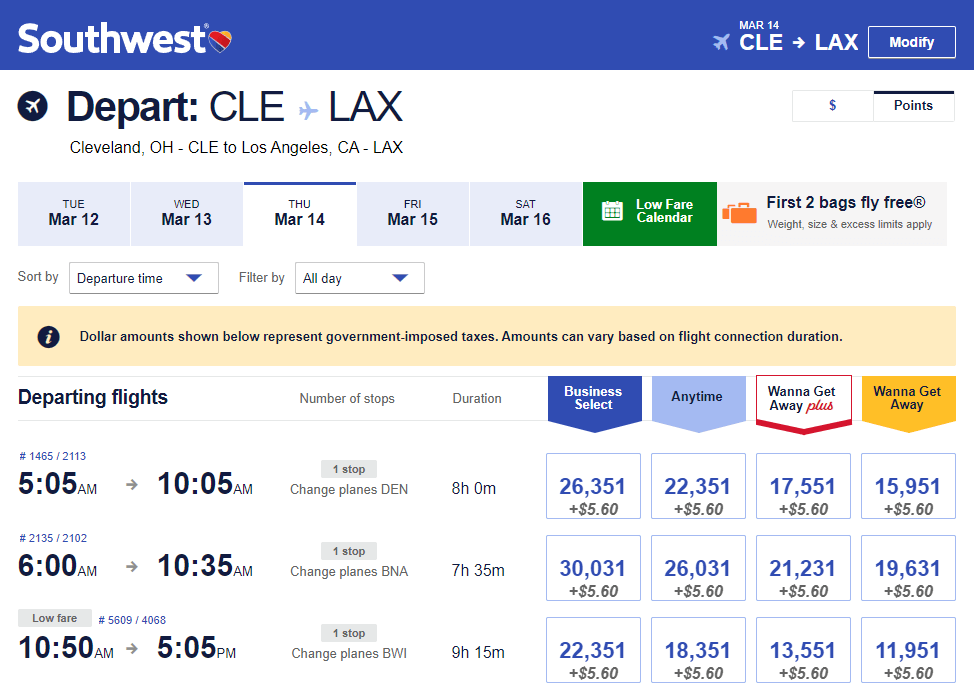

When you use points to book flights, the number of points you’ll need varies by the destination and time of booking. To give you an example, we booked a one-way flight from Ohio to Los Angeles for just under 6k points. We booked a flight home (over spring break) for 11k points. Points fluctuate so you may see them cheaper or more expensive than what I paid, but it at least gives you a rough idea of where 135k points will get you.

Now keep in mind that without the Companion Pass, you’d spend a total of 34k points for a round trip flight from Ohio to LA (17k x 2). But when using the Companion Pass benefit, you’d spend only 17k because your companion flies free (with the exception of taxes and fees).

Bonus Perks when flying Southwest

Plus, one of Southwest’s biggest perks is that you can change or cancel your flight for free—up to 10 minutes before your flight leaves. That means I can book my flight and if I see that the cost of the flight went down (either in points or money), I can log into my Rapid Rewards account and adjust my flight to get the cheaper cost! A lot of airlines charge big fees to change flights!

In addition, if we would have to cancel a trip, for any reason, I can do so without losing money or points. If you book with points and you have to cancel, those points are just deposited back into your Rapid Rewards account to be used at a later time. And if you booked with cash, depending on the fare type you selected, you’ll either get award credit or a full refund back to your original payment method. I like having that added peace of mind knowing that rescheduling a trip is an option!

Travel Hacking Credit Card Disclaimer

Anytime I write about using credit cards, I always like to follow it up by saying, this will ONLY benefit you if you pay your credit cards off monthly. If you hold any sort of balance on a credit card, be sure to pay that off BEFORE getting into the travel hacking game. The interest rates on travel credit cards is 20-30%, which is pretty hefty. If you’re paying any sort of credit card interest, points won’t be of any value. If you’re someone who already does this, then travel hacking with credit cards can really help offset your overall cost of travel!

My husband and I both use credit cards for every possible monthly expense we have, but we treat our credit cards like debit cards. We can easily hit minimum spends on credit cards and earn welcome bonuses with just typical spending. Gas, groceries, car insurance, utilities, cable/streaming/internet services, HOA fees, sports fees, etc. all add up pretty quickly for our family of five. By putting those expenses on credit cards, we earn points that allow us to travel more than we thought possible.

Is the Southwest Companion Pass in your future?

If you’re someone who doesn’t need to fly in first class seating and is open to saving money, the Companion Pass is a great option! We’re all about traveling on a budget, so we love the added benefit of flying for free!

Related Posts

How to Fly to Hawaii for Free

See how our family of 5 flew to Hawaii for nearly free using credit card…

April 14, 2024How to Book 7 Nights in Hawaii for FREE!

If you want to plan a trip to Hawaii, but are looking to save money…

April 7, 2024

Leave A Comment